Esports Industry’s Host Selection Process Proving Successful

Blast and ESL FaceIt Group are seeing more bids than ever

Posted On: March 17, 2025 By :As the esports world continues to grow, its biggest events have outgrown the old process of flying around the world and hoping to find the right destination.

These days, major esports events are getting the same treatment as traditional sports events when it comes to the bidding process, with Blast and ESL FaceIt Group leading the way.

This year, Blast will host 16 arena events across five continents and 11 countries. In addition to its 2025 Blast Major in Austin, the organization will also have major events in five of the top 10 esports titles in locations including London, Lisbon, Lyon, LA, Mexico, Rio, Raleigh and Singapore.

“We’ve had to professionalize our approach and the way we run these destination processes over time,” said James Woollard, director of market development for Blast. “A lot of this has been about digitizing our process and making it accessible to lots of cities of different sizes and scales all over the world. But also running an in-depth collaborative approach with cities to really give as many people as possible opportunities to host the biggest and best esports events within our calendar.”

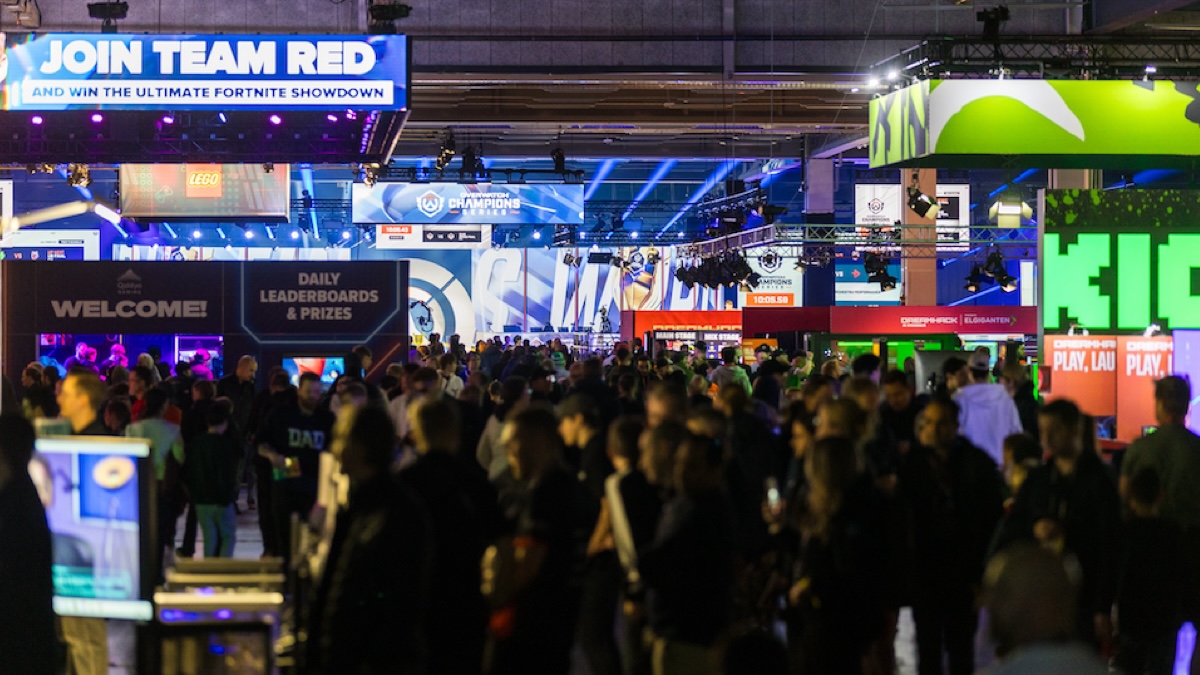

ESL FaceIt Group is best known for DreamHack, a global phenomenon. But EFG has also posted RFPs for its other major events including ESL Pro League, ESL One and Intel Extreme Masters. The company will host 17 events this year, including DreamHack in Dallas in May and in Atlanta in the fall.

“The RFP process has been a huge success, given the fact it’s the first one that we’ve actually done,” said Bobby Hare, EFG director of host city partnerships and hospitality. “We had a huge interest from the market, because we brought four events to market. We had a real big demand across all of our different products. And then going through the process was exciting.”

A New Way of Doing Business

Over the years, the esports world has largely been the Wild West in finding the right host partner. A destination had to hope for a mixture of timing and luck to host a major event. Now, everybody is getting a chance to pitch why they should host.

Woollard admits even with his global knowledge of host destinations, Blast received bids from cities he was not familiar with.

“I think it speaks to the reach of the process,” Woollard said. “We are reaching out now to hundreds of different host cities or potential host cities. We’re publicizing press releases in SportsTravel, as well as other leading publications, to reach more people. We have a destinations website so that cities can log on to watch videos, get detailed technical specs, understand the different titles and games that we have and really see the benefits for the host city as well.”

Hare has seen cities with a blend of host histories throughout the RFP process, which has given EFG more options.

“We’ve received bids from cities that have little experience when it comes to esports events but have hosted major sports events and we’ve had bids from cities that have huge experience when it comes to esports,” Hare said. “So we’ve had to spend a lot of time educating new cities on the esports world and the ecosystem, the players, the value and the economic impact that it can bring in community engagement.”

The old way of doing business — flying around the world to esports events and conferences to pitch cities on why they should host a Blast event — is a thing of the past for Woollard.

“More of the cities we’re speaking to at events like the EsportsTravel Summit are now aware of who Blast is, which is fantastic,” Woollard said. “And we’re starting the conversation now, not at, ‘What is esports?’ but at, ‘Which event can we host?’ Which is a great place to start.”

“The old process was we’d go to an event, meet somebody, we’d get a call, we’d have an exploration,” Hare added. “Now, it’s much more strategic. Market mapping, understanding the different markets that are in play, looking at the gaming communities, looking at the players, the fans. We’ve really developed over the past five years from being fairly opportunistic in our approach to having a full streamlined strategy.”

Choosing the Right Host Destination

Hare and his team have developed that strategy to narrow down the search and find top candidates. Some of the first things they look for are does the city have an esports strategy, how invested are they in esports and have they hosted esports events before? From there, Hare builds a target list.

“That target list is then looked at internally, in terms fit with our international strategy,” Hare said. “Do our brand partnerships want to go there? Are there local partners there who we think would want to activate within the gaming atmosphere? Is there a gaming industry there? Is anybody working within that ecosystem? There are lots of different touch points we consider.”

Another shift in the philosophy of these two esports giants is how they view the relationship with a host city. Woollard says in the past it was mostly a business agreement to put on the event, then Blast would leave town.

“We now try to drive some kind of really meaningful long-term partnerships with some of those cities as well,” Woollard said. “So rather than it being transactional, we’ve moved to more of a partnership model where we believe we’re delivering real long-term value for the cities that we visit.

“We have cities that are already iconic and renowned for traditional sport like Boston, Austin, Raleigh, London, Lisbon, Monterrey … and we have big sporting cities who are, in some cases, taking their first run at an esports event. We’ve spent time with them, we’ve spoken to them and they trust us to deliver impactful events for their city.”

Hare says the RFP process has expanded the playing field for potential host cities and allowed EFG to become more familiar with a city’s capabilities. In addition to being a desirable place for esports athletes and fans to visit, a destination must also have the right support for EFG to activate within the market.

If it’s a good fit, EFG runs an observer program that includes inviting five or six cities to DreamHack to see it first-hand.

“We had people from the host city team, from the commercial team, from the DreamHack team, talk about the value that these events could deliver,” Hare said. “Cities have to see this world, especially if they’ve never seen a gaming or esports event previously. How professionalized it is, the production, the fans — how engaged they are and how committed this community is to esports and their favorite players and their teams.”

The Future of Esports

Woollard and Hare have both spent years in the esports and gaming industry, so if there’s anybody qualified to predict the next 10 years in the space, it’s them.

Spoiler: they both see tremendous growth occurring.

“There are around three billion gamers, so nearly half the world’s population play some kind of game,” Woollard said. “And of those, a high percentage — and a growing percentage — are also consuming esports as a spectator sport as well. Esports isn’t going anywhere, it’s going to continue growing.”

Hare sees big expansion, especially for the largest esports companies like EFG and Blast, because esports is the entertainment choice of young people whether on a PlayStation or Xbox, a PC or on their phones.

“Within the competitive landscape, I see the bigger events getting stronger and potentially with other events, you may see a decline because of how extensive it is to be able to operate these events and because of the resources required to make these experiences so great for fans,” Hare said. “Fans will start to pick and choose where they invest their time and their energy.”

Those decisions on which events to attend can also be a group effort, as online gaming friends use DreamHack and other events to meet up.

“Fans love to have real life experiences with those people that they spend their time playing with, because they’re playing with their friends all around the world,” Hare said. “These events give them the opportunity to be able to meet in real life and spend time together where they would never have met otherwise.”

Woollard sees the esports events industry growing in numbers, but in dollars.

“The esports demographic is very young, very engaged and as these people grow older, have more buying power and consuming power and are able to make more commercial decisions, we’re going to see the value of the esports industry grow even further,” he said.

Posted in: Esports, Main Feature